WeVest Financial Planning & Advisor

Description of WeVest Financial Planning & Advisor

Are you looking for a financial adviser, advanced financial planning and thorough analysis and insights on your monthly payments?

Want to have personal debt planning, a finance guide and debt manager & personal finance planning in 1 app?

Well you need WeVest Financial Planning & Advisor!

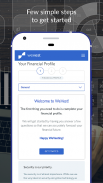

No one is going to do it for you, but you can easily take care of your future using our secure and advanced finance planner, money plan tool with detailed monthly plan, insights, budgeting and net worth optimization. If you download right now, you'll be on your right financial way in 10 minutes.

Do you want to have a financial planning tool to:

Get richer?

Be more secure about your financial future?

Pay off debt quickly?

Lower the cost of debt?

Crush your student loans?

Know you be comfortable when you stop working?

Of course you do. All of this starts with a first step. WeVest financial planner & finance guidance tool is here to help you take that first step, and the next one. Download the money plan app right now and get started today for free!

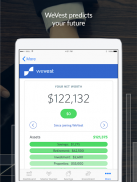

OPTIMIZE NET WORTH, ACHIEVE GOALS & MORE

With WeVest as your financial planner you can:

1) Determine your Net Worth and get insights on how to optimize and increase it

2) Set savings goals for Retirement, College, Investments, Emergency Savings

3) Determine the best way to pay off Debt and how long it will take

4) Plan for Retirement

5) Follow a plan designed to optimize growth of your Net Worth without overcommiting to one goal or another

6) Customize the plan to what works best for you

7) Test different scenarios to determine your path

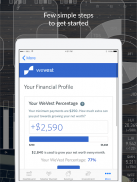

8) Compare yourself to people with a similar lifestyle to see how you are doing

9) Track and forecast your progress over time in:

Savings

Retirement Accounts (401k, IRA)

College Savings (529)

Investment Accounts

House

Mortgages

Investment Properties

Credit Cards

Student Loans

10) See when you'll achieve financial milestones

11) Project your Net Worth into the future using your specific information and plan

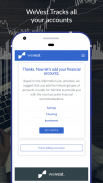

BASED ON YOUR PERSONAL FINANCIAL DATA

WeVest financial planning guidance uses real, powerful, financial planning tools that you can use, not some flimsy calculator that gives generic answers. WeVest takes into account your:

- Age

- Income

- Estimated Tax Rate (whether filing Single or Married)

- Historical Ranges of Investment Returns

- Account Balances

- Minimum Payments

- Specific Savings Goals

- Interest Rates on Savings Accounts, Credit Cards, Mortgages, Loans

- Matching and Limits in your Retirement Account

- Expected Social Security Benefit

- Inflation

- Net Income on Investment Properties

WeVest is specially designed as budgeting, debt managing and financial adviser tool that is personalized!

Using your data, WeVest looks into the future, seeing when you will pay off your mortgage, or get out of debt, or reach a savings target, and reallocates those payments to give you a clear picture of what tomorrow holds. Every time you update something, whether to test a scenario, or to update your current picture, WeVest recalculates everything and re-projects.

100% SECURE

We do not ask for your bank information, Social Security #, address, or other identifying personal information. We use 256-bit encryption to protect your information. We do not share your personal information with anyone.

Have you every wondered: How am I doing? What should I do next? Or what will happen if I do X, Y, or Z? If so, get started right now -

We will also keep you updated with the latest finance tips, personal finance news and similar handy finance advice on our blog!

Don’t miss the opportunity to master your personal finances!

Download WeVest finance planner & financial adviser and we're here to help you on your way.